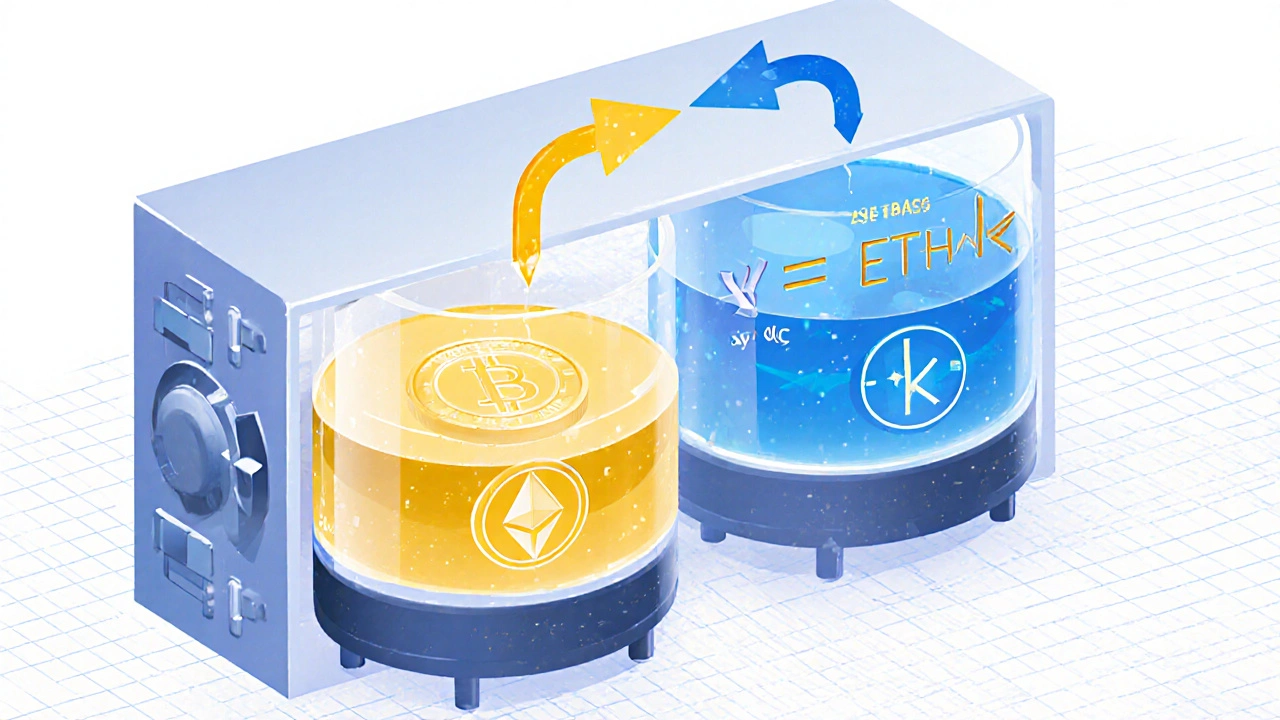

Ever wondered why you can swap tokens on a decentralized exchange without waiting for a counter‑party? The secret lies in Liquidity Pool is a smart‑contract vault that holds two (or more) cryptocurrencies and automatically prices them for trades. In this guide we’ll break down the mechanics, the math, the rewards, and the risks so you can walk away with a clear picture of how liquidity pools power modern crypto markets.

What is an Automated Market Maker?

The term Automated Market Maker is a protocol that replaces order books with a pricing algorithm, allowing anyone to trade directly against a pool of assets. Unlike traditional exchanges that match buyers and sellers, an AMM continuously offers quotes based on the current composition of its pool. This design fuels the rise of Decentralized Exchanges (DEXs) such as Uniswap, SushiSwap, and PancakeSwap, where trades happen 24/7, peer‑to‑peer, and without a central authority.

The Core Math: The Constant Product Formula

Most AMMs rely on a simple yet powerful equation known as the Constant Product Formula is a pricing rule that keeps the product of the two token reserves (x×y) equal to a constant k. When a trader swaps tokenA for tokenB, the pool’s reserves shift, and the new price is calculated to preserve the product:

k = x * y

Imagine a pool that starts with 1,000USDC and 10ETH (so x=1,000, y=10, k=10,000). If you want to buy 1ETH, the pool must receive enough USDC to keep x×y=10,000. Solving the equation shows you’d pay roughly 105USDC, leaving the pool with 1,105USDC and 9ETH. The price automatically rises as the pool gets thinner - that’s why large trades experience higher Slippage is a difference between the expected price and the executed price due to pool depth.

Why Liquidity Pools Matter: Benefits for Traders and Providers

- Continuous liquidity - No order book, no need to wait for a matching trade.

- Lower entry barriers - Anyone can become a Liquidity Provider (LP) is a person who deposits assets into a pool and earns a share of the transaction fees.

- Fee income - Most AMMs charge a small fee (e.g., 0.30%) on every swap, which is automatically distributed to LPs proportional to their share.

- Permissionless innovation - New token pairs can launch instantly without needing a market‑making team.

Risks to Keep in Mind

Liquidity pools aren’t risk‑free. The biggest headline‑grabbing hazard is Impermanent Loss is a temporary reduction in the value of your deposited assets compared to simply holding them, caused by price divergence between the paired tokens. If ETH climbs far above USDC while you’re still in the pool, you’ll end up with a less valuable mix than if you’d just held ETH and USDC separately.

Other considerations include:

- Smart‑contract bugs - A flaw in the pool’s code can drain funds.

- Gas fees - On high‑traffic chains, the cost to add or remove liquidity can eat into returns.

- Regulatory uncertainty - Some jurisdictions treat LP rewards as taxable income.

Step‑by‑Step: How to Provide Liquidity

- Choose a DEX that supports the token pair you want (e.g., Uniswap, SushiSwap).

- Connect your crypto wallet (MetaMask, Trust Wallet, etc.) to the platform.

- Select the pool and approve the two tokens you’ll deposit.

- Enter the amount of each token. Most interfaces will auto‑balance the ratio to match the pool’s current price.

- Confirm the transaction and pay the required gas fee.

- After the pool is funded, you’ll receive LP tokens that represent your share. These can be staked for extra rewards on many platforms.

- When you want to exit, redeem the LP tokens. The smart contract will return your underlying assets plus any accumulated fees, minus any impermanent loss.

Evaluating a Pool Before You Dive In

Not every pool is created equal. Use this quick checklist:

- Liquidity depth - Larger reserves mean lower slippage.

- Fee tier - Higher fees boost earnings but can deter traders.

- Volume - High daily trade volume signals active usage and steady fee flow.

- Token volatility - Pairs with correlated assets (e.g., stablecoin‑stablecoin) reduce impermanent loss.

- Smart‑contract audits - Look for reputable audits (e.g., OpenZeppelin, CertiK).

Real‑World Example: Uniswap V2 vs. Uniswap V3

| Feature | Uniswap V2 | Uniswap V3 |

|---|---|---|

| Pricing Model | Constant product (x*y=k) for the whole pool | Concentrated liquidity - LPs set custom price ranges |

| Fee Tiers | Single 0.30% fee | 0.05%, 0.30% & 1.00% options |

| Capital Efficiency | Low - liquidity spread across entire price curve | High - LPs allocate capital where it’s most needed |

| Complexity | Very simple UI/UX | More advanced UI, requires range selection |

| Typical Use‑Case | Broad token pairs, easy entry | Stablecoin‑stablecoin, high‑volume pairs |

V3’s concentrated liquidity means you can earn more fees with less capital, but you also expose yourself to a new risk: if the market price moves out of your chosen range, your assets sit idle until you rebalance.

Quick Checklist for New LPs

- Start with a low‑risk pair (e.g., USDC/DAI) to learn the mechanics.

- Calculate potential impermanent loss using online calculators before committing.

- Monitor gas prices - add liquidity when the network is cheap.

- Keep an eye on pool TVL (Total Value Locked) and daily volume.

- Consider staking LP tokens for additional yield.

Frequently Asked Questions

What’s the difference between a liquidity pool and a traditional order book?

A liquidity pool uses a preset algorithm (usually the constant product formula) to price assets, allowing instant swaps. An order book matches specific buy and sell orders, which can lead to gaps in liquidity and longer wait times.

How are fees distributed to liquidity providers?

Whenever a swap occurs, the protocol takes a small percentage (e.g., 0.30%). That amount is added to the pool’s reserves, automatically increasing each LP’s share proportionally. When you withdraw, you receive your original stake plus the accrued fees.

Can I lose more than I deposited?

No, the worst‑case scenario is that the value of your LP tokens drops to zero if the pool is drained by a hack or a contract bug. However, you can’t owe more than the assets you originally supplied.

What is the best way to reduce impermanent loss?

Choose pairs with tightly correlated prices (like stablecoin‑stablecoin or wrapped assets), use fee‑tier pools that match the expected volatility, and consider providing liquidity on platforms that offer IL insurance or rebalance tools.

Do I need to manually claim my rewards?

On most base AMMs (Uniswap, SushiSwap) the fees are auto‑claimed when you withdraw your LP tokens. If you stake LP tokens in a farm, you’ll need to claim the additional rewards manually or through a dashboard.