When you first hear about crypto, the first thing you’ll be asked is how to keep your coins safe. The answer often starts with a hot wallet. Understanding what a hot wallet is, how it works, and when to use it can save you headaches - and possibly money.

Defining the Hot Wallet

Hot wallet is a type of cryptocurrency storage that remains connected to the internet, allowing quick access for sending, receiving, and trading digital assets. Because it’s online, you can think of it like a digital checking account: convenient for daily transactions but not the place you’d stash a life‑savings stash.

How Hot Wallets Differ from Cold Wallets

To see why hot wallets matter, compare them to their offline cousin, the cold wallet. Below is a quick side‑by‑side look.

| Feature | Hot Wallet | Cold Wallet |

|---|---|---|

| Connection | Always online | Offline / air‑gapped |

| Speed of transaction | Instant | Minutes to hours (depends on device) |

| Typical use case | Daily trading, payments, dApp interaction | Long‑term storage, large balances |

| Security risk | Higher - vulnerable to hacks, phishing | Lower - no internet exposure |

| Convenient platforms | Web browsers, mobile apps, extensions | Hardware devices, paper backups |

Core Components Behind Every Hot Wallet

Even though hot wallets feel like simple apps, they rely on a few essential crypto concepts.

- Private key is a secret alphanumeric string that proves ownership of a blockchain address. Whoever holds the private key can move the funds.

- Public address (or public key) is the shareable string you give to others to receive crypto.

- Blockchain is the distributed ledger where every transaction is recorded immutably.

- Exchange platforms often integrate hot wallets so users can trade without moving funds elsewhere.

- Two‑factor authentication (2FA) adds a second layer of verification, typically via an app or SMS, to reduce unauthorized access.

Popular Hot Wallet Options

Not all hot wallets are created equal. Here are three that dominate the market in 2025.

- MetaMask is a browser extension and mobile app that supports Ethereum and compatible networks. It lets you interact directly with dApps.

- Trust Wallet is a mobile‑first wallet for a wide range of tokens, featuring built‑in staking and a built‑in DEX.

- Coinbase Wallet offers a user‑friendly interface and seamless integration with the Coinbase exchange, making it easy for beginners.

Step‑by‑Step: Setting Up Your First Hot Wallet

Getting started is easier than you think. Follow these steps, and you’ll have a functional hot wallet in under 10 minutes.

- Choose a reputable wallet app (e.g., MetaMask). Download it from the official website or app store.

- Launch the app and click “Create New Wallet.” You’ll be prompted to set a strong password.

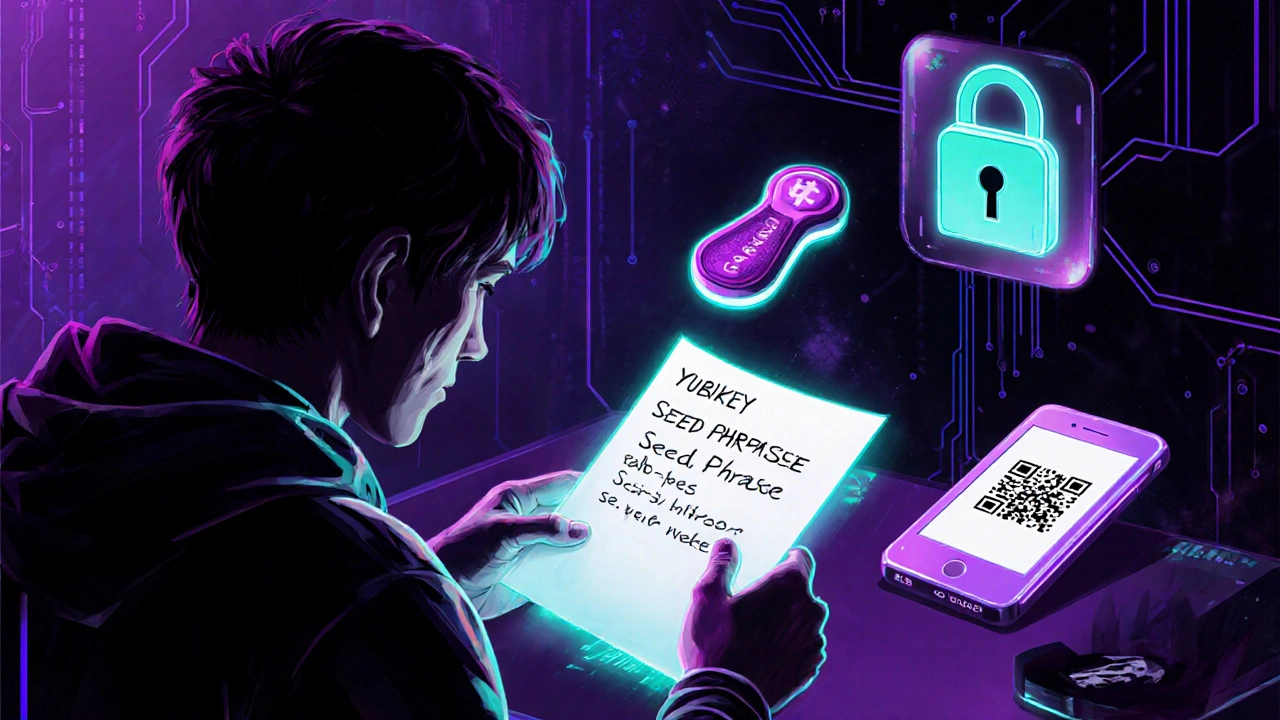

- Back up the recovery seed phrase (12‑24 words). Write it down on paper and store it somewhere safe - never save it digitally.

- Enable two‑factor authentication in the app’s security settings.

- Once the wallet is set up, you’ll see your public address. Use this address to receive crypto from exchanges or friends.

- Test the setup by sending a small amount (e.g., $5 worth of ETH) from an exchange to your new address.

That’s it! You now have a hot wallet ready for daily transactions.

Best Practices for Keeping Your Hot Wallet Safe

Convenience comes with risk. Follow these practical tips to keep your funds as safe as possible while enjoying the speed of a hot wallet.

- Never share your private key or seed phrase. Anyone with those can steal your assets instantly.

- Use a unique, strong password for the wallet app and change it regularly.

- Activate two‑factor authentication and, if available, hardware‑based 2FA (like YubiKey).

- Limit the amount stored in a hot wallet. Treat it like cash you keep in a physical wallet - enough for everyday use, but not your entire net worth.

- Beware of phishing sites. Always double‑check the URL before entering any credentials.

- Keep the app updated. Developers constantly patch security vulnerabilities.

When to Switch to a Cold Wallet

If your portfolio grows or you plan to hold coins for years, moving a portion to a cold wallet makes sense. Cold wallets, such as hardware devices, keep the private key offline, drastically reducing hack risk.

Typical signals to transition:

- Balance exceeds $5,000 in a single address.

- Holding assets for long‑term goals like retirement or inheritance.

- Storing large amounts of high‑value tokens (e.g., Bitcoin, ETH, high‑cap altcoins).

A common strategy is the “hot‑cold split”: keep a few hundred dollars in a hot wallet for daily use and the rest in a hardware wallet like Ledger Nano.

Common Misconceptions About Hot Wallets

Understanding what hot wallets are NOT helps you avoid costly mistakes.

- They are not “free money.” All wallets require careful security practices.

- A hot wallet is not the same as an exchange’s custodial wallet. The exchange holds the private keys, not you.

- Being online does not automatically mean insecure - reputable wallets employ encryption, sandboxed environments, and regular audits.

What is the main advantage of a hot wallet?

Speed. A hot wallet lets you send, receive, and trade crypto instantly because it’s always connected to the internet.

Is a hot wallet safe for large sums?

It’s best for smaller, everyday amounts. For large balances, store the majority in a cold wallet or hardware device.

Can I use a hot wallet on multiple devices?

Yes. Most wallets sync via cloud or QR code, but you must protect the seed phrase and enable 2FA on each device.

What happens if I lose my phone?

You can restore the wallet on a new device using the recovery seed phrase. Ensure that phrase is stored offline and never shared.

Do hot wallets support all cryptocurrencies?

Not all. Most mainstream wallets cover Bitcoin, Ethereum, and major ERC‑20 tokens. For niche coins, you may need a specialized app or a cold wallet.

10 Comments

Hot wallets are great for everyday crypto activity, but treating them like a vault for large sums can invite trouble. Keep only the amount you need for trading or payments and store the rest in a cold solution.

In the fast‑moving ecosystem of decentralized finance, an agile on‑ramp to liquidity is paramount.

A hot wallet acts as your primary node of interaction, bridging the fiat‑to‑crypto pipeline with minimal latency.

By leveraging hierarchical deterministic (HD) seed architecture, you can generate an infinite cascade of addresses without ever exposing the root mnemonic.

This cryptographic abstraction empowers users to engage in multi‑chain arbitrage, liquidity mining, and automated market‑making without the friction of nightly hardware provisioning.

Moreover, the inherent API exposure of most hot wallet SDKs enables seamless integration with smart contract orchestration frameworks such as Hardhat or Truffle.

When you pair a hot wallet with a robust hardware security module (HSM) for key‑encryption, you substantially mitigate the attack surface presented by constant internet connectivity.

Nevertheless, the trade‑off remains: every additional layer of security introduces latency, which can erode the competitive edge in high‑frequency yield farming strategies.

Practitioners often adopt a tiered risk model, allocating a fraction of their capital-typically 5‑10%-to the hot wallet tier while the lion's share resides in cold storage.

This allocation system mirrors traditional finance's cash‑equivalent holdings versus long‑term investment buckets.

To further harden your hot wallet posture, activate multi‑factor authentication, enable biometric safeguards on mobile, and regularly audit permission scopes granted to dApp connectors.

Audits should include a review of approved contract addresses, as rogue token approvals have been a vector for phishing exploits in the past year.

Additionally, keep your client software up to date, as developers frequently patch vulnerabilities that could be leveraged for remote code execution.

From a user experience perspective, the convenience of instant token swaps via integrated decentralized exchanges (DEXes) offsets the marginal increase in operational risk for modest balances.

In summary, a hot wallet is the operational front‑line of your crypto workflow, and with disciplined best practices it can be both swift and sufficiently secure.

So, embrace the hot wallet for day‑to‑day transactions, but always pair it with a solid cold‑storage contingency plan to preserve your wealth.

Sure, you could stash every satoshi in a hardware vault and pretend the internet doesn't exist, but then you'd miss out on the whole thrill of watching a DeFi flash loan liquidate in seconds.

Hot wallets are basically the espresso shot of crypto-quick, jitter‑inducing, and best enjoyed in moderation.

If you keep your entire portfolio on a brash browser extension, you might as well hand out your passwords to strangers at a party.

That said, a well‑configured hot wallet with two‑factor authentication and a hardened seed phrase is not the same as leaving your front door wide open.

Think of it like a bank safe deposit box: you still need the key, but you also have a guard watching the hallway.

Remember, the biggest hack ever wasn't a sophisticated zero‑day exploit; it was a user who wrote their seed phrase on a sticky note.

So, use a hot wallet for daily swings, but don't let it become the sole guardian of your retirement fund.

In short, balance the convenience with a healthy dose of paranoia, and you won't end up crying over a lost private key.

Picture this: you've just earned a fresh batch of tokens from a liquidity pool, heart pounding, eyes glued to the screen, and suddenly the app crashes.

That gut‑wrenching moment is why a hot wallet must be both swift and shielded, like a knight in shining armor racing through a storm.

By enabling biometric locks and setting strict session timeouts, you give yourself a safety net without sacrificing the thrill of instant trades.

And when the inevitable phishing attempt slides into your inbox, remember that a vigilant mind is your most potent defense.

Hot wallets let you move money fast but keep most of it safe elsewhere

Hot wallets, by design, provide immediate access to assets, which is essential for active traders, but they also expose private keys to the internet, increasing vulnerability, therefore, implementing multi‑factor authentication, regularly updating the software, and storing the seed phrase offline are critical, indeed, these practices dramatically reduce risk, while still preserving the convenience that hot wallets are celebrated for.

Ever wonder why the big exchanges never reveal how they keep the billions safe? Some say they're using secret off‑grid vaults, but the real magic is probably a hidden hot wallet network controlled by a shadow committee that feeds us just enough access to keep us hooked.

Anyway, if you trust a friendly app with your seed phrase, you might as well hand the keys to the kingdom to a clown.

Everyone jumps on the hot‑wallet hype like it's the only path to financial freedom, yet few consider the systemic implications of keeping billions of dollars perpetually connected to a hostile internet.

From a macro perspective, a decentralized populace using hot wallets en masse creates a massive attack surface that state actors could weaponize.

Moreover, the convenience narrative ignores the fact that most users lack the technical literacy to secure their seed phrases adequately.

Thus, the industry should prioritize education over flashy UI upgrades, and perhaps even mandate hardware‑backed key storage for accounts exceeding a modest threshold.

Until then, we're just bubbling in a fragile ecosystem, willing to sacrifice security for the illusion of instant liquidity.

In short, hot wallets are a double‑edged sword: they empower daily transactions but also sow the seeds of a potential catastrophic breach.

Only keep a few dollars in a hot wallet.

Hot wallets are perfect for quick swaps and everyday use, but remember they’re still online, so treat them like a cash wallet.

If you need serious security, move the bulk to a hardware device.